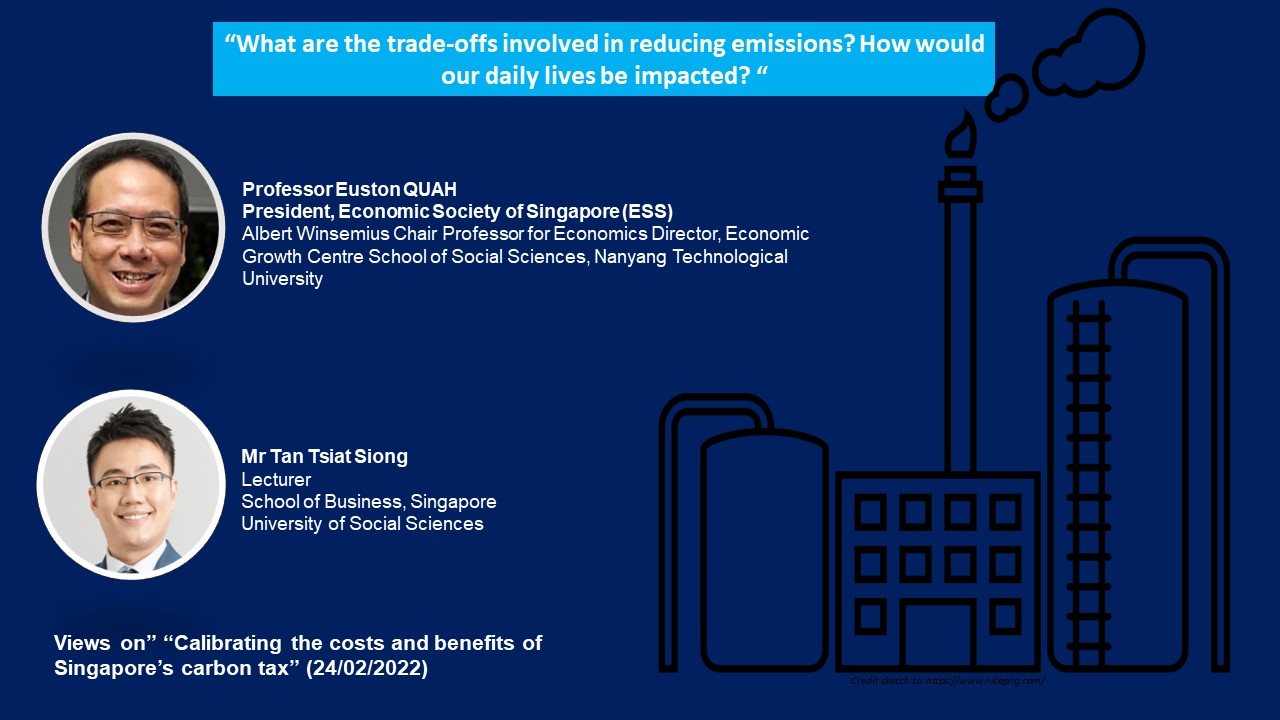

"But two immediate questions arise: What are the trade-offs involved in reducing emissions? How would our daily lives be impacted?"

24 February 2022 :Prof Euston Quah on ” Calibrating the costs and benefits of Singapore’s carbon tax”

“The trade-off? Rising business costs and a squeeze on profits. As an export-oriented economy – exports constitute more than 170 per cent of our gross domestic product – Singapore runs the risk of its international competitiveness being hurt by the imposition of a substantial carbon tax as our trading partners turn to competitors who, without a carbon tax, can under-price us”.

“In his Budget speech, Finance Minister Lawrence Wong said that an increase in carbon tax to $25 a tonne is estimated to lead to a rise in utility bills for an average household by $4. What about the impact on our overall cost of living?”

To read more, click here. (Source: SUSS & Straits Times)